News & Events

Women and finances

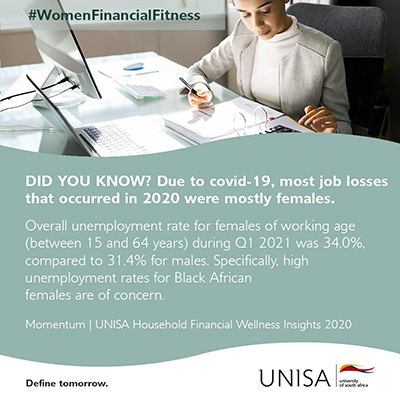

Several studies reveal that women all over the world are lagging behind when it comes to finances. They earn less, save less, and, with the money they have, save or invest less, if at all. This often is owed to systematic set-ups and expectations rooted within society. These expectations range from women being primary caregivers to earning less than men for the same jobs men do, among other things.

Jacolize Meiring from Unisa’s Bureau of Market Research says: “All over the world, but especially in South Africa, women have tough times. In modern South Africa, they are expected to work, do household duties, buy groceries, care for loved ones, including kids at school, interrupt careers to have children, etc., whilst, at the same time, having to contend with gender-based violence on an unprecedented scale.

While these challenges abound, the most effective way to change this status quo is for women to own up to their financial situation and take control, as well as learning how to manage their finances.

Meiring asserts that: “Women, however, are slowly regaining their rightful place in South Africa. Equality in terms of the number of jobs had almost been reached before the lockdown. When the hard labour jobs such as mining and construction are excluded, 50% of workers were women,” she says.

Given societal expectations and systematic restrictions against women, managing money amidst life other expectations is challenging. Most women struggle to earn adequate money or to access opportunities while performing gender-imposed obligations. To change the status quo, however, women must take the initiative to educate themselves about financial decisions.

The Momentum Unisa Household Financial Wellness Insights 2020 report suggests that to become more involved and even take the lead in managing their household financial situations, women need to empower themselves with financial knowledge, with a mindset of openness to change, and an optimistic outlook that tends to lead to smart money choices.

The report further asserts that to achieve your goals, you need a plan. But any plan, whether it is compiled by a government, company, or household, will remain just a plan until it is implemented. Implementation, however, needs a plan of its own, known as an implementation plan—maps the original plan’s goals and targets, the specific skills needed for successful implementation, and the intended activities and completion dates, all within a specific budget. Then, execution must occur.

For more reading, click here for the Momentum Unisa Financial Wellness Insights 2019 report

Enabling platforms

Women need to pursue enabling opportunities or platforms to address their financial circumstances and challenges. For employed women, there’s often a lot to juggle daily. Many women have to balance their professional lives with caring for the children, household responsibilities, and during the lockdown, they have had to fit in home-schooling among other daily duties; as a result, their involvement or efforts in household finances takes a backseat.

As a Unisa employee, besides financial courses that staff can pursue at the expense of the employer, the university also offers another enabling platform like the Financial Wellness Office.

The Unisa Financial Wellness Office has been set up to ensure that Unisa employees are able to access sound financial wellness advice and services. The office adopts a holistic approach in the delivery of its financial wellness proposition. To this end, services offered include the following:

- Free financial assessments

- A free copy of the employee’s credit report

- Investigating whether employees are victims of reckless lending (where cases of reckless lending are found, having the loan set aside or at the very least getting the creditor to make concessions on the interest and fees charged on the loan)

- Investigating illegal garnishee orders (with the view to setting them aside)

- Ensuring that employees are not over-charged on their debts (possible breaches of the in duplum rule by creditors)

- Guiding employees who experience a monthly shortfall given their income, expenses and debt commitments on how they can reverse the shortfall

- Guiding employees who are under debt administration as well as debt counselling on how to survive

- Assisting with wills and tax returns

- Guiding employees when they shop around for home loans

- Assisting with better-priced insurance, as well as investment policies and products

These services are offered to Unisa employees free of charge. Most importantly, employees who use these services will be well on their way to financial wellness. For more details, employees can call 010 900 3212 or 079 372 0100.

#WomenFinancialFitness

*By Tshimangadzo Mphaphuli, Senior Journalist, Department of Institutional Advancement

Publish date: 2021-08-20 00:00:00.0